VR Learning Research

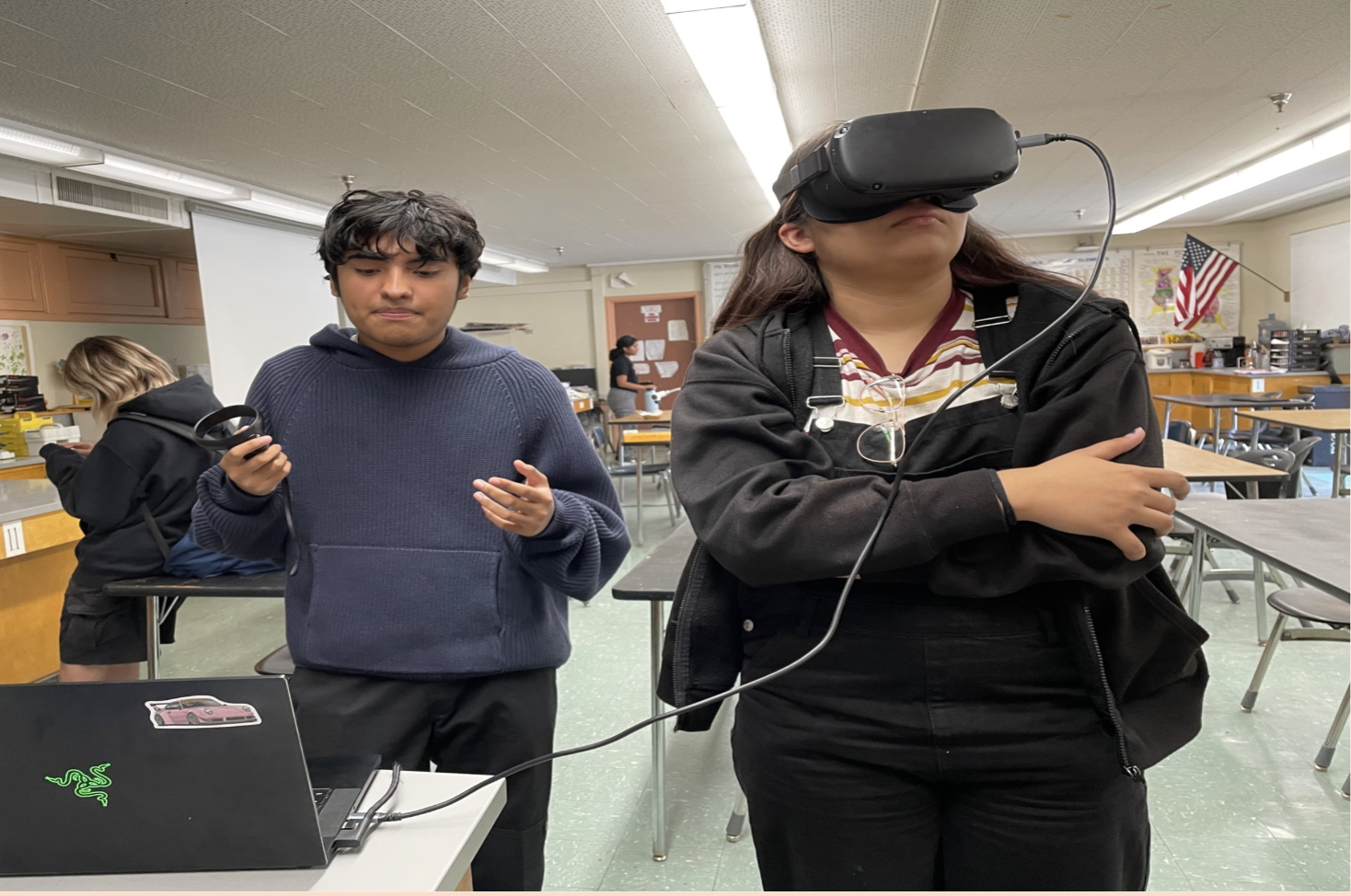

As a part of the Networked Systems Lab in USC's Viterbi School of Engineering, I collaborated with professor Ramesh Govindan and Ph.D. student Rajrup Ghosh to explore the intersection of technology, history, and education. By utilizing a game engine called Unity, an Oculus virtual reality headset, and a computer, I was able to construct historical scenes within virtual reality.

Upon completion, teachers, students, and children could immerse themselves in the history of the U.S., visualizing early British colonization of the New World, the American Revolution, and the present-day U.S.

Stock Analysis Project

I conducted an in-depth analysis of Twitter’s stock to evaluate whether it represented a buy or sell opportunity. The analysis began by examining the industries Twitter operates in, along with the core services it provides and how those services generate revenue. I then explored Twitter’s customer base and competitive landscape, highlighting how major rivals such as Facebook, Instagram, and TikTok influence its market position.

The financial section focused on Twitter’s revenue and profits during the 2020 fiscal year, with particular attention to its operating profit and overall profitability. I also reviewed historical stock prices and dividend activity to understand how investors have responded to Twitter’s performance. By combining market insights with financial data, the presentation offered a clear picture of Twitter’s strengths, weaknesses, opportunities, and threats, ultimately addressing whether the stock should be considered a buy or sell.